On August 6, 2025, Zoho Corporation unveiled the Singapore edition of Zoho Books, a cloud-based accounting software designed to simplify GST compliance and e-invoicing for businesses in Singapore. This launch also includes tailored editions of Zoho’s finance and operations suite, enabling businesses to streamline financial and operational processes while adhering to local regulations. Below are the key highlights of the press release and a comparison of Zoho Books with Zoho’s existing invoicing, billing, and payment solutions.

Key Points from the Zoho Books Singapore Edition Launch

- GST and E-Invoicing Compliance: Zoho Books automates GST calculations, generates IRAS-ready F5 returns, and supports e-invoicing via PEPPOL standards, with upcoming integration with InvoiceNow for direct IRAS submission. This addresses the challenges faced by 32% of Singapore businesses filing GST manually and 71% spending up to five days preparing returns.

- AI-Driven Automation: Features like AI-powered receipt capture and Zoho Analytics integration with Zia enable businesses to automate expense recording, track financial trends, and make data-driven decisions through predictive analysis.

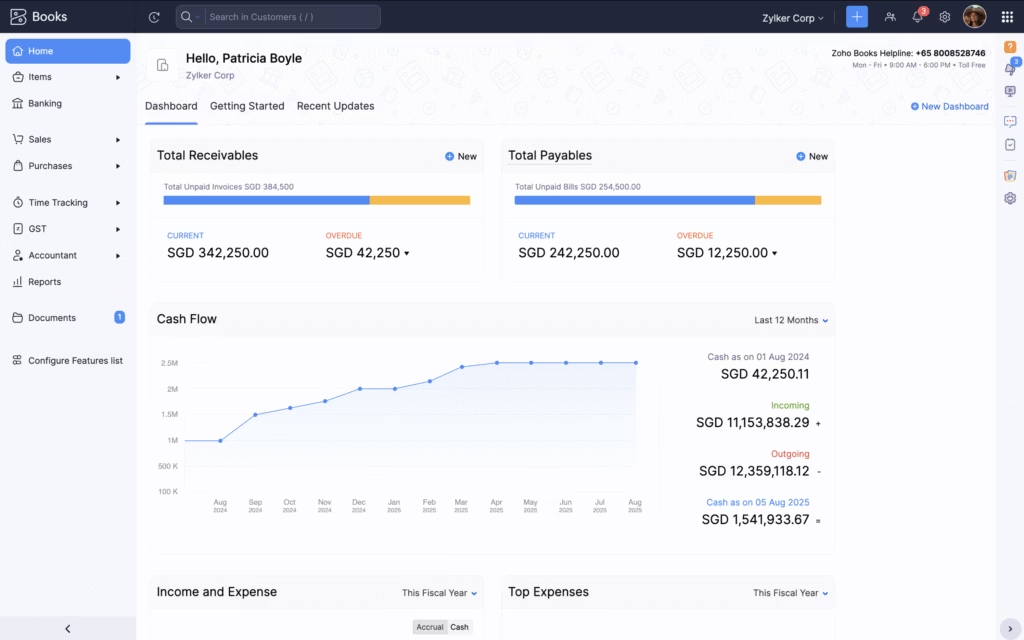

- Comprehensive Financial Management: The platform supports end-to-end finance operations, including core accounting, bank reconciliation, stock tracking, project management, and budgeting, with PayNow integration for streamlined payment collections.

- Advanced Capabilities: Zoho Books offers audit trails, order management, and workflow automation, reducing manual errors and compliance risks, especially critical given IRAS recovered $162 million in FY23/24 due to compliance lapses.

- Zoho Finance Suite: The Singapore edition includes Zoho Inventory (inventory and order management), Zoho Billing (subscription and AR automation), Zoho Invoice (free invoicing for small businesses), Zoho Expense (travel and expense management), Zoho Commerce (e-commerce platform), and Zoho Practice (for accounting professionals). These solutions are interoperable, ensuring seamless data flow and improved accuracy.

- Pricing and Availability: Zoho Books starts at S$18/month per organization with a free plan available, making it accessible for small and medium-sized enterprises (SMEs).

Comparison: Zoho Books vs. Zoho Invoice, Zoho Billing, and Zoho Expense

Zoho offers a suite of financial tools, each serving distinct purposes. Below is a comparison of Zoho Books with Zoho Invoice, Zoho Billing, and Zoho Expense, focusing on their functionalities, target users, and compliance features for the Singapore market.

| Feature | Zoho Books | Zoho Invoice | Zoho Billing | Zoho Expense |

|---|---|---|---|---|

| Primary Function | Comprehensive accounting software for end-to-end financial management. | Free invoicing solution for managing receivables. | Subscription and one-time billing with AR automation. | Travel and expense management with automated reporting. |

| Key Features | GST-compliant invoicing, e-invoicing (PEPPOL, soon InvoiceNow), bank reconciliation, inventory management, project tracking, AI-driven receipt capture, Zoho Analytics with Zia. | GST-compliant invoices, quotes, payment reminders, multi-currency support, customer portal. | GST-compliant billing, subscription management, Quote-to-Cash, trial management, prorated billing, revenue reporting. | Expense reporting, self-booking for travel, per diem automation, policy-compliant travel allowances. |

| Compliance | Automates GST calculations, IRAS-ready F5 returns, e-invoicing, audit trails. | GST-compliant invoices, basic e-invoicing support. | GST and e-invoicing compliance, AR automation. | Compliance with Singapore government per diem and travel rules. |

| Target Users | SMEs needing full accounting, inventory, and project management. | Freelancers and small businesses focused on invoicing. | Businesses with subscription-based or one-time billing needs. | Businesses managing employee travel and expenses. |

| Integration | Integrates with Zoho suite (CRM, Inventory, Analytics) and third-party apps like PayPal, Stripe. | Integrates with Zoho Books, CRM, and payment gateways. | Integrates with Zoho Books, CRM, and payment gateways. | Integrates with Zoho Books and other Zoho apps for expense tracking. |

| Pricing | Starts at S$18/month, free plan available. | Free forever. | Pricing varies, not specified in the press release. | Pricing not specified in the press release. |

| Limitations | May have a learning curve for complex setups; limited custom report templates. | Limited to invoicing and basic receivables; no full accounting. | Focused on billing, lacks full accounting or inventory features. | Limited to expense and travel management, not a full accounting tool. |

Key Differences

- Scope: Zoho Books is a comprehensive accounting solution, covering invoicing, expense tracking, inventory, and project management, making it ideal for SMEs with diverse needs. Zoho Invoice focuses solely on invoicing and receivables, suitable for freelancers or small businesses. Zoho Billing specializes in subscription and one-time billing, while Zoho Expense is tailored for travel and expense management.

- Compliance and Automation: Zoho Books offers advanced GST compliance, e-invoicing, and automation (e.g., AI receipt capture, IRAS-ready returns), surpassing the simpler GST-compliant invoicing in Zoho Invoice and Zoho Billing. Zoho Expense automates travel-related compliance but lacks broader accounting features.

- Use Case: Zoho Books is best for businesses needing an all-in-one solution, while Zoho Invoice is ideal for those requiring free, simple invoicing. Zoho Billing suits subscription-based businesses, and Zoho Expense is for companies prioritizing employee expense tracking.

- Cost: Zoho Invoice’s free plan is a standout for small businesses, while Zoho Books’ paid plans (starting at S$18/month) offer more features. Pricing for Zoho Billing and Zoho Expense was not detailed in the press release but typically aligns with specific needs.

Comparison of Singapore GST-Compliant Bookkeeping Solutions

This comparison evaluates Zoho Books (Singapore Edition) against other popular GST-compliant bookkeeping solutions available in Singapore, focusing on their features, compliance capabilities, pricing, and suitability for businesses. The solutions compared are QuickBooks Online, Xero, and Wave, as they are widely recognized for their GST compliance and financial management features in the Singapore market.

Comparison Table: Zoho Books vs. QuickBooks Online, Xero, and Wave

| Feature | Zoho Books (Singapore Edition) | QuickBooks Online | Xero | Wave |

|---|---|---|---|---|

| Primary Function | Comprehensive accounting with GST compliance, e-invoicing, inventory, and project management. | Cloud-based accounting with invoicing, expense tracking, and GST compliance. | Cloud-based accounting with strong GST compliance and third-party integrations. | Free accounting and invoicing for small businesses with GST compliance. |

| GST Compliance | Automates GST calculations, generates IRAS-ready F5 returns, supports e-invoicing (PEPPOL, soon InvoiceNow), and provides audit trails. | GST-compliant invoices, automated GST calculations, and IRAS-ready reports. | GST-compliant invoicing, automated tax calculations, and IRAS filing support. | Basic GST-compliant invoicing and reporting, suitable for simple needs. |

| E-Invoicing | Supports PEPPOL standards, with upcoming InvoiceNow integration for IRAS submission. | Limited e-invoicing; supports basic electronic invoicing but not PEPPOL-compliant. | Supports PEPPOL e-invoicing and InvoiceNow integration for IRAS compliance. | Limited e-invoicing; no PEPPOL or InvoiceNow support. |

| Key Features | AI-driven receipt capture, Zoho Analytics with Zia for predictive insights, PayNow integration, inventory and project management, workflow automation. | Customizable invoices, automated payment reminders, bank reconciliation, payroll (additional cost), and multi-currency support. | Bank feeds, project tracking, inventory management, customizable reports, and strong third-party app integrations. | Free invoicing, expense tracking, receipt scanning, and basic reporting; payroll and payments incur fees. |

| Integrations | Seamless integration with Zoho suite (CRM, Inventory, Billing, etc.) and payment gateways like PayPal, Stripe, and PayNow. | Integrates with PayPal, Stripe, Shopify, and third-party apps; strong payroll integrations. | Extensive integrations with over 800 apps, including Stripe, PayPal, and Hubdoc. | Integrates with PayPal, Stripe, and Google Sheets; fewer third-party options. |

| Target Users | SMEs needing an all-in-one solution with GST compliance and advanced automation. | Small to medium businesses with complex accounting needs and payroll requirements. | SMEs and startups needing scalability and robust third-party integrations. | Freelancers and small businesses with simple accounting needs and tight budgets. |

| Ease of Use | User-friendly interface with mobile apps; setup may be complex for advanced features. | Intuitive dashboard; steeper learning curve for advanced features. | Clean interface, easy to use, but may require setup time for integrations. | Simple and beginner-friendly, ideal for non-accountants. |

| Pricing | Starts at S$18/month per organization; free plan available for basic needs. | Starts at S$15/month (Simple Start, promotional pricing); higher tiers S$30–S$70/month. | Starts at S$20/month (Early plan, promotional pricing); higher tiers S$35–S$65/month. | Free for accounting and invoicing; payment processing fees (1–2.9%) and payroll (~S$6/employee/month). |

| Limitations | Limited payroll support (requires Zoho Payroll integration); complex setup for large businesses. | Higher cost for advanced features; payroll and e-invoicing not as robust for Singapore. | No built-in payroll for Singapore; higher cost for advanced plans. | Limited features for complex accounting; no advanced inventory or project tracking. |

| Security | SSL encryption, two-factor authentication, and compliance with SOC 2 Type II, ISO 27001. | AES-256 encryption, two-factor authentication, and compliance with SOC 1, SOC 2. | Bank-grade encryption, two-factor authentication, and GDPR compliance. | AES-256 encryption; limited advanced security features compared to others. |

Detailed Comparison

- GST Compliance and E-Invoicing

- Zoho Books: Excels with automated GST calculations, IRAS-ready F5 returns, and PEPPOL-compliant e-invoicing, with planned InvoiceNow integration. Its audit trail and real-time GST updates address Singapore’s regulatory needs, especially given IRAS’s $162 million recovery in FY23/24 due to compliance lapses.

- QuickBooks Online: Offers robust GST compliance with automated tax calculations and IRAS-compatible reports. However, its e-invoicing capabilities are less advanced, lacking PEPPOL or InvoiceNow support, which may limit efficiency for B2B businesses.

- Xero: Strong GST compliance with automated tax calculations and PEPPOL/InvoiceNow support, making it ideal for businesses prioritizing e-invoicing. It simplifies IRAS filing but lacks built-in payroll for Singapore.

- Wave: Provides basic GST-compliant invoicing and reporting, suitable for freelancers but less robust for complex GST needs or e-invoicing, as it lacks PEPPOL/InvoiceNow support.

- Features and Functionality

- Zoho Books: A comprehensive solution with AI-driven receipt capture, Zoho Analytics for predictive insights, and PayNow integration. It supports inventory, project management, and workflow automation, making it ideal for SMEs with diverse needs.

- QuickBooks Online: Offers customizable invoices, bank reconciliation, and multi-currency support. Its payroll feature (additional cost) is a plus, but it’s less tailored for Singapore-specific e-invoicing compared to Zoho Books.

- Xero: Strong in bank feeds, project tracking, and inventory management, with extensive third-party integrations (e.g., Stripe, Hubdoc). It’s scalable but lacks some of Zoho’s AI-driven automation features.

- Wave: Free accounting and invoicing with receipt scanning and basic reporting. It’s ideal for simple needs but lacks advanced features like inventory management or project tracking.

- Pricing and Value

- Zoho Books: Affordable at S$18/month with a free plan, offering strong value for SMEs needing GST compliance and automation.

- QuickBooks Online: Starts at S$15/month (promotional), but higher tiers can be costly (up to S$70/month). It’s less budget-friendly for small businesses compared to Zoho Books.

- Xero: Starts at S$20/month (promotional), with higher tiers up to S$65/month. It’s competitively priced but lacks a free plan.

- Wave: Free for core accounting and invoicing, with fees for payments (1–2.9%) and payroll (~S$6/employee/month). It’s the most cost-effective for freelancers but limited for growing businesses.

- Integrations and Ecosystem

- Zoho Books: Benefits from seamless integration with Zoho’s suite (CRM, Inventory, Billing) and payment gateways like PayNow, Stripe, and PayPal, enhancing interoperability for Singapore businesses.

- QuickBooks Online: Integrates with PayPal, Stripe, and third-party apps like Shopify. Its ecosystem is robust but less extensive than Zoho’s for non-accounting functions.

- Xero: Offers over 800 integrations, including Stripe, PayPal, and Hubdoc, making it highly extensible for businesses needing diverse app connections.

- Wave: Limited integrations (PayPal, Stripe, Google Sheets), suitable for basic needs but less scalable for complex workflows.

- Suitability for Singapore Businesses

- Zoho Books: Ideal for SMEs needing a comprehensive, Singapore-specific solution with GST compliance, e-invoicing, and AI-driven automation. Its PayNow integration and upcoming InvoiceNow support align well with local needs.

- QuickBooks Online: Best for businesses with complex accounting or payroll needs, but its e-invoicing limitations may hinder B2B efficiency in Singapore.

- Xero: Suited for startups and SMEs prioritizing scalability and e-invoicing compliance, though it lacks built-in payroll for Singapore.

- Wave: Best for freelancers and small businesses with simple accounting needs and tight budgets, but not suitable for complex GST or operational requirements.

Why Choose Zoho Books?

Zoho Books stands out for its ability to integrate accounting, inventory, and project management with Singapore-specific GST and e-invoicing compliance. Its AI-driven features and interoperability with Zoho’s finance suite make it a robust choice for SMEs aiming to streamline operations and reduce compliance risks. Businesses with simpler needs may prefer Zoho Invoice for free invoicing or Zoho Billing for subscription management, while Zoho Expense complements travel-heavy organizations.

For more details, explore Zoho Books and its suite at Zoho’s official website.

Zoho Corporation

With 55+ apps in nearly every major business category, Zoho Corporation is one of the world’s most prolific technology companies. Zoho is privately held and profitable with more than 18,000 employees globally with headquarters in Austin, Texas and international headquarters in Chennai, India. Zoho APAC HQ is located in Singapore. For more information, please visit:

www.zoho.com/

Zoho respects user privacy and does not have an ad-revenue model in any part of its business, including its free products. The company owns and operates its data centers, ensuring complete oversight of customer data, privacy, and security. More than 120 million users around the world, across hundreds of thousands of companies, rely on Zoho everyday to run their businesses, including Zoho itself. For more information, please visit: